Hi, today I have been thinking since evening about what to write and share with you. Sitting and reflecting… finally, I got it! Today, I will share my experience of managing my business expenses.”

Running one business is tough. But managing two? That’s a whole new level of challenge. I’ve been there. I run two businesses: Genztool, a digital tools review site, and Boreal Diary, a travel blog about Scandinavia.

Over the years, I’ve picked up some practical tips to keep my expenses in check. Without hurting growth or quality. Want to know how? Let me share my journey with you.

Track every penny: Keeping a close eye on where your money goes is key. Think of it like managing your household budget. Every expense counts.

Invest wisely: Only spend on what truly adds value. Like buying a good coffee machine if it helps you work better.

Plan for the unexpected: Always have a little extra saved up. You never know when you might need it. Think of it as an emergency fund for your business.

The good news? These tips can help any business. Big or small. Just like they helped me. Let me share my experience to help you navigate your financial journey.

Why is Managing Business Expenses Important?

Ever wonder where all your money goes? Keeping track of your expenses can really help. Why? Because it lets you see exactly where you’re spending. This means you can make smarter choices about your finances.

The best part? It helps you avoid overspending. And stick to your budget.

Here’s what you’ll gain:

Better financial decisions

Control over your spending

Peace of mind knowing you’re within your budget

Take it from me, I used to wonder where my money went every month. Once I started tracking my expenses, everything changed. I felt more in control and less stressed. You can too!

Simple Steps to Manage Business Expenses

1. Start with a Clear Budget

One of the first lessons I learned was the importance of budgeting. For each business, I created a dedicated budget based on income projections, recurring expenses, and growth goals.

For example, with Genztool, I allocated funds for premium tools like VPNs, AI software, and SEO tools. Meanwhile, Boreal Diary required expenses for travel, photography equipment, and web hosting. By separating these budgets, I could avoid cross-business overspending and stay focused on each business’s needs.

2. Track Every Expense

When managing multiple businesses, it’s easy to lose track of where your money is going. I make it a habit to document every single expense—big or small—for both businesses. Using accounting software has been a game-changer. Tools like QuickBooks or Xero allow me to categorize expenses, generate reports, and ensure nothing slips through the cracks.

Pro Tip: Set up separate bank accounts for each business. This separation simplifies bookkeeping and ensures your financial records stay clean.

3. Invest in What Matters Most

Every business has its unique priorities. For Genztool, investing in high-quality SEO tools like SEMrush and content creation AI ensures the platform remains competitive. For Boreal Diary, I focus on quality travel experiences and photography to captivate my audience.

I’ve learned that strategic investments—rather than cutting corners—yield better long-term results. The key is to identify which areas will deliver the most value for your business and allocate funds accordingly.

4. Negotiate with Vendors

Whether it’s renewing web hosting plans, purchasing software, or booking travel accommodations, negotiation can save you a significant amount. For Boreal Diary, I’ve secured discounts with local tour operators by highlighting potential collaborations. Similarly, I’ve often reached out to SaaS providers for Genztool to negotiate better rates.

Don’t hesitate to ask for discounts or explore alternative options. You might be surprised by how often vendors are willing to work with you.

5. Leverage Tax Benefits

Tax management is crucial for controlling business expenses. By working with a professional accountant, I’ve been able to identify tax-deductible expenses for both businesses, such as software subscriptions, travel costs, and office supplies.

For instance, many of the tools I use for Genztool qualify as business expenses, reducing my taxable income. Similarly, travel-related expenses for Boreal Diary, such as airfare and accommodation, often qualify as deductions. Staying tax-savvy is a must for business owners.

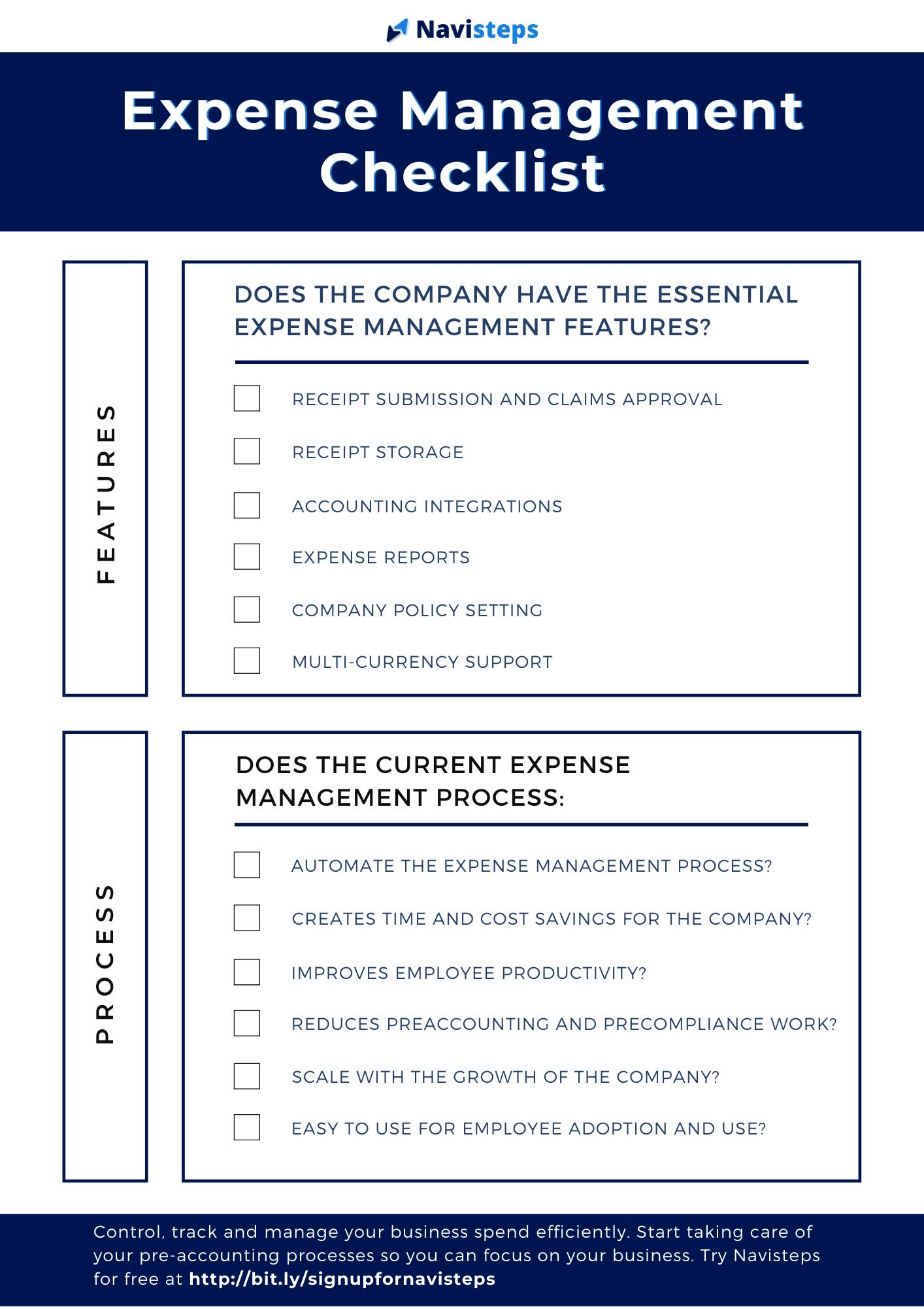

6. Use Technology to Simplify Management

Managing expenses for two businesses would be overwhelming without the right tools. I rely heavily on apps and software to streamline processes. Tools like Trello keep my projects organized, while budgeting apps help monitor cash flow in real-time.

You can Use tools like Invoiless to track and manage your expenses. These tools make it easy to keep everything organized.

Automation is another lifesaver. By automating recurring payments, I’ve freed up time and reduced the risk of late fees.

7. Review and Optimize Regularly

One of the biggest lessons I’ve learned is the importance of regular reviews. Every quarter, I analyze my expenses for both Genztool and Boreal Diary to identify areas of improvement. Are there any subscriptions I no longer need? Am I overspending in certain categories? These reviews help me refine my strategies and stay on top of my finances.

8. Plan for the Unexpected

Finally, always have a contingency fund. Unforeseen expenses are inevitable. Whether it’s unexpected website maintenance for Genztool or a canceled trip for Boreal Diary, having a financial cushion has saved me from unnecessary stress.

9. Separate Personal and Business Expenses

Why? Because it makes tracking your business spending so much easier.

Think of it like this: Mixing personal and business expenses is like trying to untangle a bunch of knotted cords. It’s a mess.

So, do yourself a favor:

Open a separate bank account for your business.

Use different credit cards for personal and business purchases.

Trust me, your future self will thank you!

Using Invoiless to Manage Your Business Expenses

One of the best tools to manage your business expenses is Invoiless. It is an all-in-one invoicing solution that helps you create, send, and track invoices.

Feature | Benefits |

|---|---|

Create Invoices | Create invoices quickly and easily. |

Send Invoices | Send invoices to clients directly from the platform. |

Track Invoices | Keep track of all your invoices in one place. |

Manage Payments | Accept online payments securely with Stripe, PayPal, and more. |

Generate Reports | Generate reports to see your income and expenses. |

Benefits of Using Invoiless

Invoiless offers many benefits for small to medium businesses, freelancers, and developers:

All-in-One Platform: Manage all your invoices in one place.

Easy to Use: The intuitive interface makes it easy to create and manage invoices.

Get Paid Faster: Accept online payments securely and get paid faster.

Save Time: Spend less time on invoicing and more time on your business

Better Customer Experience: Provide a better experience for your customers with professional invoices.

How to Get Started with Invoiless

Getting started with Invoiless is easy. Follow these simple steps:

Sign Up: Visit the Invoiless website and sign up for an account.

Create Your First Invoice: Use the easy invoice builder to create your first invoice.

Send the Invoice: Send the invoice to your client directly from the platform.

Track Your Invoices: Keep track of all your invoices and payments in one place.

Frequently Asked Questions

What Are The Key Steps To Manage Business Expenses?

Track spending, set budgets, review regularly, and use tools for efficiency.

How Can I Create A Business Expense Policy?

Define allowable expenses, set limits, and communicate the policy clearly.

What Tools Help With Managing Business Expenses?

Use software like QuickBooks, Expensify, and Invoiless for tracking and reporting.

Why Is It Important To Track Business Expenses?

Helps with budgeting, tax preparation, and identifying cost-saving opportunities.

Conclusion

Managing business expenses isn’t just about cutting costs; it’s about making smarter financial decisions. By budgeting, tracking expenses, and leveraging technology, I’ve been able to grow both Genztool and Boreal Diary sustainably. If you’re running multiple businesses or even just starting with one, these strategies can help you stay in control and set yourself up for success.

Remember, your financial habits shape your business’s future. Start small, stay consistent, and watch your efforts pay off!Managing business expenses doesn’t have to be hard. By tracking your expenses, setting a budget, and using tools like Invoiless, you can keep your finances in check. Start managing your business expenses today and watch your business grow!

For more information about Invoiless, visit their website: https://genztool.com/invoiless/.