When I started my small business, managing money felt confusing. I needed something to help me keep track of everything. That’s when I found QuickBooks.

QuickBooks is a tool that makes handling money much easier. It helps me see how much money comes in, how much I spend, and how much profit I make. I don’t have to guess anymore. It saves me time and helps me avoid mistakes.

The first step is setting it up the right way. Once I did that, everything started to make more sense. In this guide, I’ll show you how I did it, step by step.

Get ready to take control of your business money. With QuickBooks, I now understand my numbers better—and you can too.

Choosing The Right QuickBooks Version

Selecting the right QuickBooks version is crucial for small businesses. Each version offers unique features. Understanding these differences helps in making the best choice. Your decision should align with your business needs. Consider factors like budget, business size, and accounting complexity.

Comparing Online And Desktop Options

QuickBooks provides two main options: online and desktop. QuickBooks Online is cloud-based. It allows access from anywhere with an internet connection. This option is great for businesses with remote teams. Automatic updates and backups simplify your accounting tasks.

QuickBooks Desktop is installed on your computer. It offers powerful features and customization. This version is ideal for businesses with specific needs. However, it lacks the flexibility of the online version. Choose based on your team’s work style and needs.

Understanding QuickBooks Self-employed

QuickBooks Self-Employed is designed for freelancers and independent contractors. It helps track income and expenses easily. This version simplifies tax preparation, making it less stressful. It allows you to separate personal and business finances.

Self-Employed offers features like invoicing and mileage tracking. It is a cost-effective solution for solo entrepreneurs. Review your business model to see if this version fits your needs.

Initial Setup Process

Setting up QuickBooks for small business accounting involves several simple steps. Begin by creating your account, choosing the right version, and entering your company details. Connect your bank accounts and set up your chart of accounts to start tracking your finances effectively.

Setting up QuickBooks for your small business is an essential step towards efficient accounting. The initial setup process can feel overwhelming, but breaking it down into manageable steps makes it easier. This guide will help you navigate the first phases of setting up QuickBooks, ensuring you lay a solid foundation for your financial tracking.

Launching QuickBooks Software

To start, install the QuickBooks software on your computer. If you’re using QuickBooks Online, simply visit the official website and log in. Once you open QuickBooks, you’ll be greeted by a user-friendly interface. Take a moment to explore the dashboard. Familiarize yourself with the layout, as this will help you navigate seamlessly in the future. Have you ever faced confusion while trying to locate a feature? By knowing where things are right from the start, you can save time and avoid frustration.

Creating Your New Company File

Now, it’s time to create your company file. Click on the “Create a new company” option. You’ll be guided through a series of prompts, which will ask for important information about your business. Enter your business name, address, and type of business. This information is crucial, as it customizes QuickBooks to fit your needs. You’ll also need to set up your chart of accounts. This is where you categorize your income, expenses, assets, and liabilities. Think about how you want to track your finances. Are you aware of the different categories that apply to your business? Taking the time to consider this will help you get more accurate reports later on. After you input all necessary details, QuickBooks will create your company file. It may take a few moments, but once it’s done, you’re officially set up! With your company file ready, you can start managing your finances effectively. QuickBooks will help you keep everything organized, making it easier to stay on top of your accounting tasks. Your journey into streamlined accounting has just begun. What features will you explore first?

Navigating The Quickbooks Interface

Setting up QuickBooks for small business accounting is straightforward. Familiarize yourself with the interface to easily navigate features like invoicing and expense tracking. This guide will help you through the initial setup, ensuring you manage your finances effectively.

Navigating the QuickBooks interface can seem daunting at first, but once you get the hang of it, you’ll find it intuitive and user-friendly. This section will guide you through the essential components of the interface. Let’s break it down into two key areas: the Dashboard and the Main Features.

Exploring The Dashboard

The QuickBooks dashboard is your command center. It provides a snapshot of your business’s financial health at a glance. You’ll find important metrics like income, expenses, and profit trends right here. Use these insights to make informed decisions. Take a moment to customize your dashboard. You can add or remove widgets based on what matters most to you. This personal touch can make your accounting tasks feel less overwhelming. Have you ever felt lost in a sea of numbers? The dashboard simplifies this by presenting data in a clear, concise manner.

Utilizing The Main Features

QuickBooks is packed with features designed to streamline your accounting tasks. Start with the invoicing tool. It allows you to create, send, and track invoices effortlessly. Next, explore the expenses section. You can categorize and manage your spending, making budgeting a breeze. This feature can help you identify areas where you can cut costs. Don’t forget about bank integration. Connecting your bank account enables automatic transaction downloads. This saves time and reduces manual entry errors. If you’re unsure about a feature, use the help menu or the search bar. These tools are designed to guide you through any uncertainties you may encounter. What features do you think will save you the most time? Take a moment to reflect on how QuickBooks can tailor its functionalities to your unique business needs. Navigating QuickBooks will become second nature as you familiarize yourself with these key components. Get ready to take control of your small business accounting!

Credit: www.fourlane.com

Customizing Your Company Settings

Customizing your company settings in QuickBooks is vital. It helps tailor the software to fit your business needs. Start by entering your company information. Then set your tax preferences. Both steps ensure accurate accounting and reporting.

Entering Company Information

Begin by entering your basic company information. Click on the gear icon at the top right. Select “Account and Settings” from the dropdown menu. Here, you will find the “Company” tab.

Fill in your company name, address, and phone number. These details show up on invoices and reports. Ensure the information is accurate. This helps maintain professionalism.

Next, add your business logo. A logo enhances your brand’s visibility. Upload a clear image in the logo section. This logo appears on all customer-facing documents.

Setting Up Tax Preferences

Setting up tax preferences is essential for compliance. Navigate to the “Taxes” tab in the same settings menu. Select the option that matches your business type.

Enter your business’s tax ID number. This number is crucial for tax filings. Choose your sales tax rate, or add new rates if needed.

Review your tax settings regularly. Changes in tax laws may affect your business. Keeping your preferences updated helps avoid penalties.

Managing Your Chart Of Accounts

Setting up QuickBooks for small business accounting starts with managing your chart of accounts. This allows you to organize financial data effectively. Proper setup ensures accurate tracking of income and expenses, leading to better financial insights. Follow these steps for a smooth accounting experience.

Managing your Chart of Accounts is a crucial step in setting up QuickBooks for your small business. This foundational element organizes your financial data, making it easier to track income, expenses, and overall financial health. A well-structured Chart of Accounts helps you understand where your money is coming from and where it’s going, empowering you to make informed decisions.

Creating Account Categories

Start by defining your account categories. These categories act as the backbone of your Chart of Accounts. – Assets: This includes cash, inventory, and equipment. – Liabilities: Track what you owe, like loans and accounts payable. – Equity: Understand your ownership stake, including retained earnings. – Income: Document revenue streams from sales or services. – Expenses: Monitor costs, such as salaries, rent, and utilities. Think about your business needs. You may need to create subcategories for better granularity. For example, if you run a restaurant, breaking down food costs and labor can provide valuable insights.

Organizing Financial Data

Once you’ve created your categories, it’s time to organize your financial data. Clarity is key. Consider using a numbering system for your accounts. This allows for easier tracking and reporting. For instance, assign a range of numbers for assets (1000-1999) and liabilities (2000-2999). Make sure to regularly review and update your Chart of Accounts. As your business grows, your accounting needs may change. In my experience, I once overlooked a category for marketing expenses. After adding it, I realized how much I was spending on promotions. This small change gave me insights that helped me adjust my marketing strategy effectively. Are you ready to take control of your finances? Your Chart of Accounts is your roadmap to better financial management. Organizing it thoughtfully will pay off in clarity and insight.

Credit: www.montrealfinancial.ca

Connecting Bank And Credit Card Accounts

Setting up QuickBooks for small business accounting involves connecting your bank and credit card accounts. This integration helps you track transactions easily and maintain accurate financial records. Start by selecting your financial institution and following the prompts to link your accounts securely.

Connecting your bank and credit card accounts in QuickBooks is a crucial step in setting up your small business accounting. This integration allows you to streamline your financial management, automate transaction recording, and maintain accurate records with ease. By linking your accounts, you can save time and reduce errors, giving you more freedom to focus on growing your business.

Automating Transaction Imports

Linking your bank and credit card accounts to QuickBooks enables automatic transaction imports. This feature allows QuickBooks to fetch your transaction data directly from your financial institutions. – Set up bank feeds: Go to the “Banking” menu and select “Link Account.” Follow the prompts to enter your bank’s details. – Choose your accounts: Select which bank accounts or credit cards to connect. This will allow QuickBooks to automatically download your transactions. With transactions importing automatically, you can spend less time on data entry. This convenience not only improves accuracy but also helps you track your expenses in real-time. How much time do you think this could save you each week?

Reconciling Bank Statements

Reconciling your bank statements is essential to ensure your records match your bank’s records. QuickBooks makes this process straightforward. – Access the reconciliation tool: Navigate to the “Accounting” menu and select “Reconcile.” Choose the account you want to reconcile. – Match transactions: QuickBooks will display your transactions. Simply check off each transaction that appears on your bank statement. This process helps identify discrepancies, enabling you to correct any errors promptly. I remember the first time I reconciled my accounts; it felt satisfying to see everything balance out perfectly. Have you ever experienced the relief of a successful reconciliation? By connecting your bank and credit card accounts, you enhance your accounting efficiency. Automating transaction imports and reconciling statements are vital steps in maintaining accurate financial records. Focus on these areas, and you’ll set a solid foundation for your small business accounting.

Handling Sales And Invoicing

Effective sales and invoicing are crucial for small business success. QuickBooks simplifies these processes. It helps you create invoices, track sales, and manage payments effortlessly. This section covers how to design invoice templates and process payments.

Designing Invoice Templates

Creating a professional invoice is essential. QuickBooks offers customizable templates. You can add your logo, business name, and contact details. Choose colors that match your brand. Include clear item descriptions and prices.

Set payment terms on your invoices. Specify due dates and late fees if needed. This encourages timely payments. Save your template for future use. This saves time and ensures consistency.

Processing Payments And Receipts

QuickBooks makes payment processing simple. You can accept various payment methods. Customers can pay via credit cards, bank transfers, or checks. This flexibility increases your chances of getting paid.

Once a payment is received, record it in QuickBooks. This keeps your accounts accurate. Generate receipts automatically after payments. This helps maintain clear records for both you and your customers.

Monitor your sales reports regularly. This helps you understand cash flow. Adjust your strategies based on the data. QuickBooks provides insights into your financial health.

Maximizing Quickbooks For Reporting

Setting up QuickBooks for small business accounting streamlines financial management. Proper configuration enables effective tracking of income, expenses, and reports. This guide offers simple steps to optimize QuickBooks for better insights and decision-making.

Maximizing QuickBooks for Reporting can significantly enhance your small business’s financial insights. By leveraging the reporting features of QuickBooks, you can gain a clearer understanding of your financial health. This empowers you to make informed decisions that align with your business goals.

Generating Financial Reports

Generating financial reports in QuickBooks is straightforward and essential for tracking your business performance. Start by navigating to the “Reports” menu on your dashboard. You can customize reports to include specific date ranges, categories, and other filters relevant to your business. Use the Profit and Loss report to see your income and expenses over a specific period. This report helps you identify profitable areas and those that may need adjustment. Another vital report is the Balance Sheet, which provides a snapshot of your assets, liabilities, and equity. This report can guide you in understanding your overall financial position and planning for future growth.

Tracking Sales And Expenses

QuickBooks makes tracking sales and expenses simple and efficient. You can categorize your expenses to see where your money goes, making it easier to cut costs and increase profits. Regularly updating your sales data helps you understand which products or services are performing best. For instance, I noticed a significant drop in sales for a particular service. By analyzing my reports, I identified the issue and adjusted my marketing strategy, leading to an increase in sales. Utilizing the “Class Tracking” feature allows you to assign specific transactions to different departments or projects. This way, you can analyze which areas are profitable and which may need improvement. Are you ready to take your QuickBooks reporting to the next level? By mastering these tools, you can transform your data into actionable insights that drive your business forward.

Troubleshooting And Support

Setting up QuickBooks for small business accounting can seem challenging. Troubleshooting and support are essential to resolve any issues during the setup process. With the right guidance, managing your finances becomes simpler and more efficient, allowing you to focus on growing your business.

When setting up QuickBooks for your small business, it’s important to know that challenges may arise. Troubleshooting and support options are essential to ensure your accounting software runs smoothly. Whether you encounter technical issues or have questions about specific features, QuickBooks offers several resources to help you get back on track.

Using Quickbooks Help Menu

The Help Menu in QuickBooks is a powerful tool at your disposal. To access it, simply click on the “Help” icon located at the top right corner of your screen. This menu provides a wealth of information including: – Search Functionality: Type in keywords related to your issue for instant guidance. – Step-by-Step Guides: Find detailed articles that walk you through various functions. – Video Tutorials: Visual learners can benefit from QuickBooks’ extensive library of instructional videos. If you find yourself stuck, don’t hesitate to use the Help Menu. I remember a time when I was unsure how to reconcile my accounts. A quick search in the Help Menu led me directly to a step-by-step guide that made the process straightforward.

Accessing Community Forums

Community forums are another valuable resource for troubleshooting. QuickBooks hosts a vibrant community where users share their experiences and solutions. Here’s how to make the most of these forums: – Browse Topics: Check out categories that match your issue. You might find someone has already answered your question. – Post Your Question: If you can’t find what you need, don’t hesitate to ask. Be specific about your issue to get the best responses. – Engage with Others: Sometimes, the best insights come from fellow users. Share your experiences and tips to help others. I once posted a question about payroll processing in the community forums. Within hours, multiple users chimed in with solutions that worked for me. This collaborative spirit can make all the difference in finding the support you need. With these resources at your fingertips, you’ll be equipped to tackle any QuickBooks challenge that comes your way. Are you ready to dive into the world of efficient accounting?

Enhancing Quickbooks With Add-ons

QuickBooks is a powerful tool for small business accounting. It helps manage finances effectively. Yet, its true potential can be unlocked with add-ons. These add-ons expand its features and improve functionality. They cater to various business needs. Choosing the right apps can streamline tasks and save time.

Exploring Popular Quickbooks Apps

Many apps integrate seamlessly with QuickBooks. They enhance reporting, invoicing, and payroll processes. Some popular apps include TSheets for time tracking. This app helps manage employee hours easily. Another useful app is Bill.com. It simplifies bill payments and invoice management.

Shopify connects your online store with QuickBooks. It syncs sales data effortlessly. For inventory management, consider TradeGecko. This app helps track stock levels efficiently. Each app offers unique benefits that can optimize your workflow.

Integrating Third-party Tools

Integrating third-party tools with QuickBooks improves efficiency. Tools like Salesforce enhance customer relationship management. These connections provide better insights into sales data. Email marketing platforms like Mailchimp can also link to QuickBooks. This helps manage customer outreach effectively.

Using payment processors like PayPal or Square is essential. They simplify transactions and sync directly with your accounts. This integration keeps financial records accurate and up-to-date. Explore these options to find the best fit for your business.

Credit: quickbooks.intuit.com

Frequently Asked Questions

How Do I Set Up Quickbooks For My Small Business?

To set up QuickBooks for your small business, first, open the software. Select “Create a new company” and follow the prompts. Enter your business details, including name and address. Choose your accounting method and set up accounts. Finally, customize settings to fit your business needs.

Why Don’t Accountants Like Quickbooks?

Accountants often dislike QuickBooks due to its complexity and frequent updates. Many find it less reliable for advanced accounting needs. Some features may lack depth, making detailed reporting difficult. Additionally, user errors can lead to significant issues, affecting overall financial accuracy.

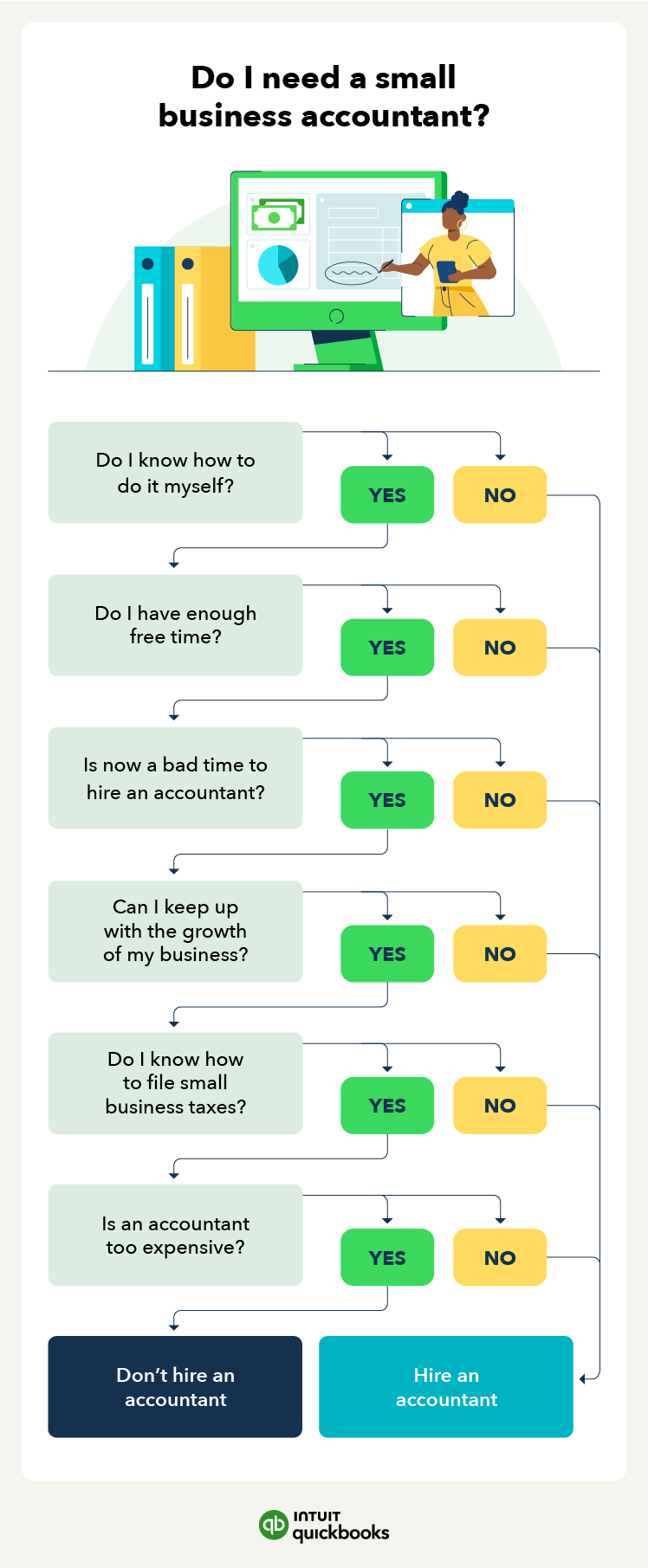

Do I Need An Accountant To Set Up Quickbooks?

You don’t need an accountant to set up QuickBooks. The software offers user-friendly features and guided prompts for setup. However, consulting an accountant can help ensure accurate financial tracking and compliance. Consider professional advice if you’re unfamiliar with accounting principles.

Is Quickbooks Good For Beginners?

QuickBooks is user-friendly and ideal for beginners. It offers straightforward navigation and helpful tutorials. The software simplifies accounting tasks, making it easier to manage finances. Overall, QuickBooks equips beginners with essential tools for effective bookkeeping.

Conclusion

Using QuickBooks was one of the best choices I made for my business. It took the stress out of managing money and helped me stay organized. Now, I spend less time worrying about numbers and more time growing my business.

If you’re just getting started, don’t worry—it gets easier. Take it one step at a time. Once you understand how to use QuickBooks, everything starts to fall into place.

I’m glad I took the leap. You can too. Take control of your finances today and give your business the strong foundation it deserves.